All Categories

Featured

Table of Contents

Premiums are typically lower than whole life plans. With a level term policy, you can select your coverage quantity and the plan length.

And you can't squander your policy during its term, so you will not obtain any economic benefit from your previous insurance coverage. As with other kinds of life insurance, the expense of a level term policy relies on your age, insurance coverage needs, employment, way of living and wellness. Commonly, you'll find a lot more economical protection if you're more youthful, healthier and much less dangerous to insure.

Because degree term premiums remain the very same for the period of protection, you'll recognize precisely how much you'll pay each time. Degree term insurance coverage additionally has some flexibility, allowing you to tailor your plan with additional functions.

You may have to fulfill certain conditions and credentials for your insurance company to pass this motorcyclist. There likewise could be an age or time limitation on the coverage.

What happens if I don’t have Level Term Life Insurance For Young Adults?

The survivor benefit is normally smaller, and coverage normally lasts up until your child turns 18 or 25. This rider may be a more affordable means to help guarantee your children are covered as bikers can commonly cover several dependents simultaneously. As soon as your kid ages out of this insurance coverage, it might be possible to transform the cyclist into a brand-new plan.

When comparing term versus permanent life insurance policy, it's crucial to keep in mind there are a couple of various types. The most usual kind of permanent life insurance coverage is whole life insurance coverage, but it has some crucial differences compared to degree term protection. Below's a fundamental summary of what to take into consideration when contrasting term vs.

Whole life insurance policy lasts for life, while term insurance coverage lasts for a certain period. The premiums for term life insurance policy are typically reduced than whole life insurance coverage. However, with both, the costs remain the very same for the period of the plan. Whole life insurance coverage has a cash value component, where a portion of the costs may expand tax-deferred for future needs.

What should I look for in a Best Level Term Life Insurance plan?

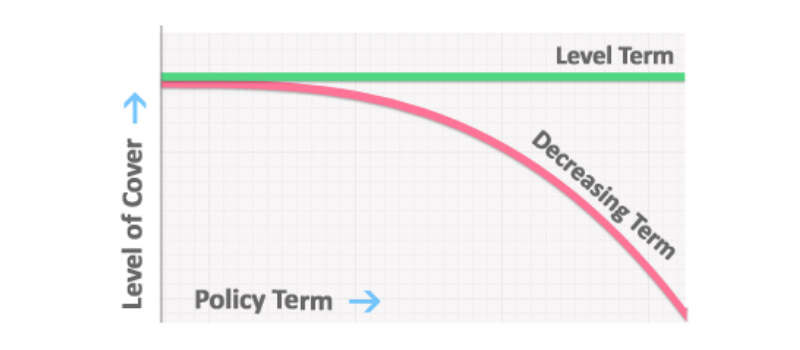

One of the main features of degree term coverage is that your costs and your death advantage do not transform. You might have coverage that starts with a death benefit of $10,000, which can cover a home mortgage, and then each year, the death advantage will certainly lower by a set quantity or percent.

As a result of this, it's frequently a more affordable kind of degree term coverage. You might have life insurance policy through your employer, yet it may not suffice life insurance policy for your demands. The very first action when acquiring a policy is identifying how much life insurance policy you need. Think about aspects such as: Age Family dimension and ages Work status Earnings Debt Lifestyle Expected final expenses A life insurance calculator can help establish just how much you require to start.

After choosing a plan, finish the application. For the underwriting procedure, you may need to give general personal, health, lifestyle and work info. Your insurance provider will figure out if you are insurable and the risk you may offer to them, which is shown in your premium costs. If you're accepted, sign the documents and pay your very first costs.

You might desire to upgrade your beneficiary details if you've had any type of substantial life modifications, such as a marriage, birth or divorce. Life insurance policy can occasionally feel challenging.

What is Term Life Insurance With Fixed Premiums?

No, degree term life insurance does not have cash value. Some life insurance plans have a financial investment attribute that permits you to construct cash value over time. Level term life insurance calculator. A part of your premium payments is established apart and can make passion in time, which grows tax-deferred throughout the life of your protection

These policies are frequently substantially more costly than term protection. You can: If you're 65 and your insurance coverage has actually run out, for example, you might desire to acquire a new 10-year degree term life insurance policy.

Level Death Benefit Term Life Insurance

You may be able to convert your term insurance coverage right into an entire life policy that will last for the rest of your life. Many sorts of degree term plans are exchangeable. That suggests, at the end of your coverage, you can transform some or every one of your policy to whole life insurance coverage.

Level term life insurance policy is a plan that lasts a collection term normally in between 10 and thirty years and features a degree survivor benefit and level costs that stay the very same for the entire time the plan is in result. This suggests you'll understand exactly how much your repayments are and when you'll need to make them, enabling you to budget plan appropriately.

Level term can be a wonderful alternative if you're seeking to buy life insurance policy coverage for the initial time. According to LIMRA's 2023 Insurance coverage Measure Research, 30% of all grownups in the U.S. requirement life insurance coverage and don't have any kind of sort of policy yet. Degree term life is predictable and budget-friendly, that makes it among one of the most prominent kinds of life insurance policy

A 30-year-old man with a similar profile can anticipate to pay $29 monthly for the exact same protection. AgeGender$250,000 coverage quantity$500,000 coverage amount$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Approach: Ordinary regular monthly prices are calculated for male and female non-smokers in a Preferred wellness category getting a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy plan.

Level Term Life Insurance Protection

Prices might differ by insurance firm, term, coverage amount, health and wellness course, and state. Not all plans are offered in all states. Rate image legitimate as of 09/01/2024. It's the most affordable kind of life insurance for many people. Level term life is far more affordable than an equivalent entire life insurance policy plan. It's easy to manage.

It permits you to budget plan and plan for the future. You can easily factor your life insurance policy right into your spending plan due to the fact that the costs never ever transform. You can prepare for the future just as conveniently since you know specifically just how much money your loved ones will certainly obtain in case of your lack.

Who offers flexible Level Term Life Insurance Rates plans?

In these situations, you'll typically have to go with a brand-new application procedure to obtain a much better rate. If you still need protection by the time your level term life plan nears the expiration day, you have a few alternatives.

Latest Posts

Low Cost Burial Insurance

Funeral Life Insurance Policy

What Is The Difference Between Life Insurance And Final Expense