All Categories

Featured

Table of Contents

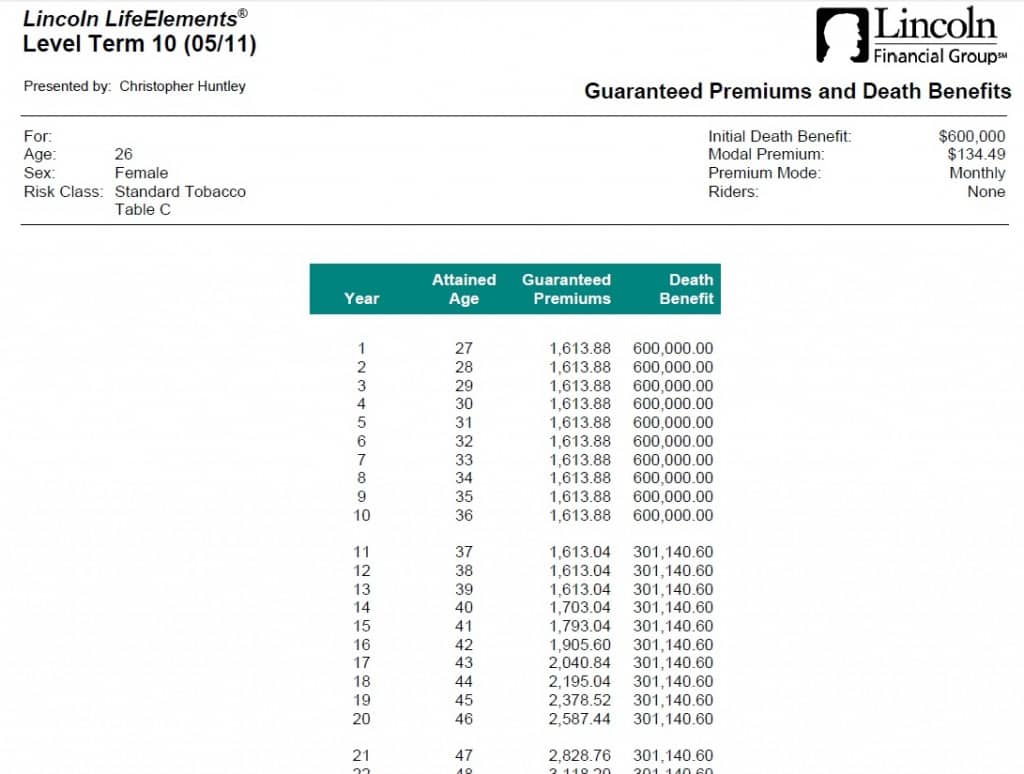

That commonly makes them a more cost effective choice for life insurance coverage. Some term policies may not maintain the premium and survivor benefit the same over time. Annual renewable term life insurance. You don't want to incorrectly think you're purchasing degree term insurance coverage and then have your survivor benefit adjustment later. Many individuals obtain life insurance protection to help economically shield their loved ones in case of their unexpected death.

Or you might have the option to convert your existing term protection into an irreversible plan that lasts the rest of your life. Various life insurance policy plans have possible advantages and downsides, so it's essential to understand each before you choose to buy a plan.

As long as you pay the premium, your beneficiaries will certainly get the survivor benefit if you die while covered. That stated, it is essential to keep in mind that a lot of policies are contestable for two years which means insurance coverage can be retracted on death, needs to a misstatement be found in the application. Policies that are not contestable typically have actually a graded survivor benefit.

What Exactly is Term Life Insurance Level Term?

Costs are generally less than whole life policies. With a level term policy, you can pick your insurance coverage quantity and the plan size. You're not locked right into an agreement for the rest of your life. Throughout your plan, you never ever need to worry concerning the costs or death advantage quantities transforming.

And you can't squander your policy throughout its term, so you will not get any economic take advantage of your past insurance coverage. As with other sorts of life insurance coverage, the price of a level term policy relies on your age, insurance coverage needs, work, way of life and health and wellness. Generally, you'll find a lot more budget-friendly protection if you're younger, healthier and less risky to insure.

Because level term costs stay the exact same for the period of insurance coverage, you'll recognize exactly how much you'll pay each time. Degree term insurance coverage also has some flexibility, permitting you to tailor your policy with additional attributes.

What Is Level Term Life Insurance Definition Coverage and How Does It Work?

You may need to meet certain problems and certifications for your insurance provider to establish this motorcyclist. Additionally, there might be a waiting duration of approximately 6 months before working. There likewise could be an age or time frame on the protection. You can include a kid motorcyclist to your life insurance policy policy so it likewise covers your children.

The survivor benefit is usually smaller sized, and protection usually lasts till your kid transforms 18 or 25. This motorcyclist may be a more economical way to aid ensure your children are covered as motorcyclists can frequently cover multiple dependents at when. Once your kid ages out of this coverage, it may be feasible to transform the cyclist into a new policy.

The most usual type of irreversible life insurance is whole life insurance policy, but it has some key differences contrasted to level term coverage. Below's a basic introduction of what to think about when contrasting term vs.

What is the Definition of Level Premium Term Life Insurance?

Whole life entire lasts insurance coverage life, while term coverage lasts insurance coverage a specific periodDetails The costs for term life insurance coverage are commonly lower than entire life insurance coverage.

One of the main functions of level term protection is that your premiums and your fatality benefit don't alter. You might have insurance coverage that starts with a death benefit of $10,000, which can cover a home mortgage, and after that each year, the fatality benefit will reduce by a set quantity or portion.

As a result of this, it's frequently an extra inexpensive sort of level term coverage. You might have life insurance coverage through your employer, yet it might not be enough life insurance coverage for your requirements. The very first step when purchasing a plan is identifying how much life insurance policy you need. Consider variables such as: Age Household size and ages Employment status Earnings Financial debt Way of living Expected last costs A life insurance coverage calculator can help establish just how much you need to begin.

What is Term Life Insurance For Seniors? A Simple Explanation?

After choosing on a plan, complete the application. For the underwriting process, you may have to supply basic personal, health, lifestyle and employment info. Your insurance provider will determine if you are insurable and the danger you may offer to them, which is shown in your premium expenses. If you're accepted, authorize the documents and pay your initial premium.

You may want to upgrade your beneficiary info if you've had any substantial life adjustments, such as a marital relationship, birth or divorce. Life insurance coverage can sometimes feel challenging.

No, degree term life insurance coverage does not have cash worth. Some life insurance policies have an investment function that allows you to construct cash worth in time. A portion of your costs settlements is alloted and can make rate of interest with time, which expands tax-deferred during the life of your coverage.

These plans are usually considerably extra expensive than term protection. If you get to completion of your policy and are still active, the coverage finishes. You have some options if you still want some life insurance policy protection. You can: If you're 65 and your protection has actually gone out, for instance, you may desire to purchase a new 10-year degree term life insurance coverage plan.

What is 10-year Level Term Life Insurance? All You Need to Know?

You might be able to convert your term insurance coverage into a whole life policy that will certainly last for the rest of your life. Lots of kinds of degree term plans are exchangeable. That means, at the end of your insurance coverage, you can transform some or every one of your plan to whole life coverage.

A degree premium term life insurance policy plan allows you stick to your budget while you assist safeguard your family members. Unlike some tipped price strategies that increases annually with your age, this sort of term strategy provides rates that remain the exact same through you pick, even as you get older or your health and wellness adjustments.

Discover more about the Life Insurance alternatives offered to you as an AICPA participant (Decreasing term life insurance). ___ Aon Insurance Coverage Providers is the brand name for the broker agent and program administration procedures of Fondness Insurance Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Company, Inc. (CA 0795465); in OK, AIS Fondness Insurance Coverage Providers Inc.; in CA, Aon Fondness Insurance Solutions, Inc .

Latest Posts

Low Cost Burial Insurance

Funeral Life Insurance Policy

What Is The Difference Between Life Insurance And Final Expense